Why extreme inequality must be at the top of the agenda at Davos 2025

The wealth gap – A global crisis

Wealth inequality is not just a statistic, it’s a daily reality for billions of people struggling to survive while watching the super-rich exploit people and planet for their profits. Oxfam’s inequality report “Takers not Makers” released today at Davos 2025 reveals the shocking scale of inequality driven by systems that prioritize wealth and power over the well-being of people and planet.

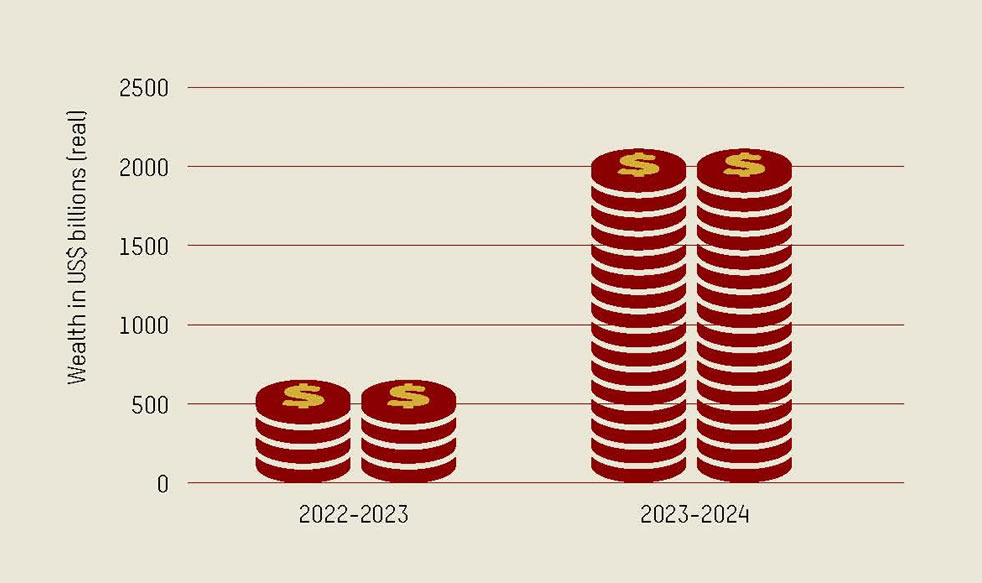

Source: Forbes

Globally, billionaire wealth grew by $2.8 trillion in 2024 alone, equivalent to roughly $7.9 billion a day, which has risen three times faster in 2024 than 2023. Meanwhile, the number of people living in poverty – nearly 3.6 billion people - has barely changed since 1990. In Canada, total billionaire wealth stood at $496.76 billion with 65 billionaires. In 2024, billionaire wealth increased by $309 million per day while 3.8 million people live below the poverty line in Canada. Canadian billionaire wealth could easily carpet most of Vancouver (93%) in CAN$50 notes.

Patterns of inequality are deeply intertwined with the persistent wealth gap, the dominance of corporate monopolies, and the lingering effects of colonial structures. The richest 1% continue to amass an ever-growing share of wealth, while millions of Canadians struggle with the costs of basics like food and shelter. It takes just 6 days for someone in the top 1 percent to make what the average person in the bottom 50 percent makes all year.

As world leaders gather in Davos, Switzerland for the World Economic Forum, we must ask what role Canada plays in perpetuating this inequality. So far, Canada has shied away from taxing the ultra-rich, which is at the heart of reducing wealth inequality. Fair taxation is a powerful tool to tackle inequality by ensuring the richest contribute their fair share and governments have the revenues to invest in public services. The Canadian government must prioritize permanent wealth taxes on the richest Canadians and ensure Canadian corporates pay their fair share of taxes by implementing an excess profits tax for companies in all sectors generating oversized profits.

Built on broken systems: Colonialism, monopolies and inheritance

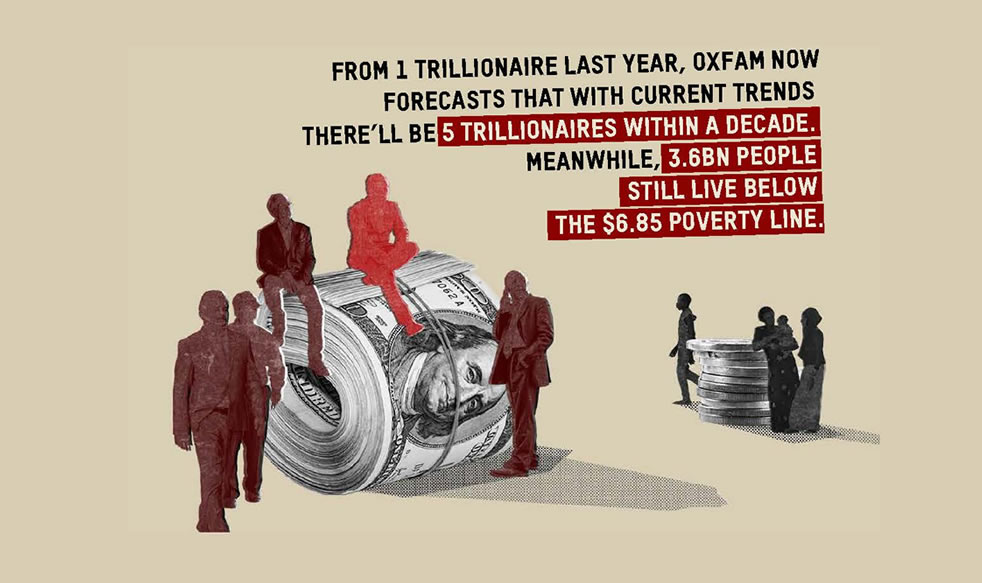

The capture of our global economy by a privileged few has reached heights once considered unimaginable. Last year Oxfam predicted the emergence of the first trillionaire within a decade. However, with billionaire wealth accelerating at a faster pace than expected this projection has expanded dramatically – at current rates the world is now on track to see at least five trillionaires within that timeframe.

Source: Oxfam Report

In Canada, since 2019, billionaire wealth has increased by $190.3 billion. There’s been a new billionaire every 12 weeks. Today’s levels of extreme wealth concentration are not based on merit or entrepreneurship, rather 61% of Canadian billionaires’ wealth is either from crony or monopolistic sources or inherited. Worst of all, the 39% of inherited wealth is going untaxed.

While inherited wealth creates deep disparities, monopolistic structures exacerbate inequality by concentrating power in the hands of a few, dictating prices, wages and conditions. As corporate giants consolidate power, they stifle competition and control markets, perpetuating wealth inequality. In fact, 20 percent of billionaire wealth is derived from monopolistic practices in Canada. As Canadians grapple with soaring grocery bills, retail grocery stores record billions in profits – a real slap in the face for the 3.8 million Canadians living below the poverty line. This stark contrast reveals how unchecked monopoly power deepens inequality and fuels the affordability crisis that Canadians are now facing.

To fully understand the nature of today’s inequality crisis, it is critical to understand the long shadow of the colonial past and how it continues to shape the present. The concentration of wealth and power can be traced back to colonial exploitation of resources and land at the expense of Indigenous communities and the environment. One prominent example is Canada’s oil and gas industry – a high pollution industry that exploits Indigenous lands and accelerates climate change. Indigenous peoples and communities often face toxic environmental pollution, housing shortages, food insecurity, and a host of other gendered impacts, as well as human rights violations and the inability to preserve their cultures, while corporations and the ultra-rich amass exorbitant amounts of wealth from the extractive industry.

Colonialism continues to rear its ugly head in present-day Canada through the exploitation of land stolen from Indigenous communities. While settlers in Canada benefitted immensely from colonization, Indigenous communities continue to face extreme poverty exacerbated by the lack of access to basic public infrastructure like clean water and ongoing violence against their communities, especially women and girls,

Legacies of inequality, which was pioneered during the time of historical colonialism, continue to shape modern lives, creating a deeply unequal world. Modern-day colonialism shapes our world in which wealth is systematically extracted from the Global South to primarily benefit the richest people in the Global North. In 2023, the richest 1% in Canada were paid $2.66 billion from the Global South through the financial system. Just one example is the fashion industry, which is built on the backs of the millions of women who make our clothes in the Global South. While top fashion executive’s wealth skyrockets, women in the Global South earn poverty wages, just $6-$11 per day, struggling to meet basic needs. This disparity isn’t accidental – it’s part of a deeply embedded colonial structure that allows the ultra-rich to thrive on the exploitation of people at the bottom.

Canada’s wake-up call: Dethrone the ultra-rich aristocracy and decolonize our economy

It is time world leaders at Davos 2025 commit to real action, and not just words, to tackle inequality. People around the world are fed up watching the super rich living excessive and polluting lives while the world is on fire. World leaders must come together and act now to radically and rapidly reduce inequality, decolonize our economy and dethrone the ultra-rich aristocracy. With inequality continuing to rise to ever more extreme levels around the world, including in Canada, it is critical that governments take immediate steps right now to reduce extreme wealth.

We Call on Canada to:

- Rapidly Reduce Inequality

Ensure Canadian corporations pay their fair share. Raise the federal corporate tax rate to 20% and implement a windfall tax for companies in all sectors generating oversized profits to stabilize Canada’s affordability crisis. - Tax the Super-Rich to End Extreme Wealth and Climate Crisis

Introduce a permanent wealth tax on the richest Canadians immediately. This tax should be at least 2% for wealth over $5 million, 3% for wealth over $50 million, and 5% for wealth over $1 billion. The government should also introduce additional equality-boosting measures such as an inheritance tax. - Combat Aggressive Tax Planning and Avoidance

Commit to a public review of all federal tax loopholes for individuals and corporations, including the capital gains loophole. Modernize the general anti-avoidance rule regime to avoid corporate tax dodging via tax havens and support the negotiations for a UN tax convention. - Advance Justice for Indigenous Peoples

Right the wrongs of history by implementing the TRC Calls to Action that provide steps to address ongoing structural harms faced by Indigenous Peoples and accelerate the swift application of the UN Declaration of the Rights of Indigenous Peoples Act. - Curb Corporate Greed

Introduce legally binding measures to guarantee the rights of women and racialized peoples, including ensuring mandatory human rights and environmental due diligence, redefining corporate purpose, and regulating corporate governance so that companies operate in the interests of people and the planet. - Tackle the Global Debt Crisis

Canada must support discussions on the global debt crisis and prioritize moving forward a multilateral framework for debt resolution during its G7 presidency.